In the previous blog titled LONG-RANGE CAPITAL INVESTMENT PLANNING we talked about how to incorporate capital budgeting and investment into your long-range financial planning. It is imperative to address those items that will be or may already be deteriorating. This will both save you money and help you stay competitive.

Some of the items we are talking about would be outdated equipment (HVAC, kitchen, office) as well as cosmetic items (carpets, décor, window treatments). By spending the money to update equipment, you could be saving your community money in the long run by faster, more efficient operations. And the importance of keeping common spaces and individual living units updated is necessary to stay competitive especially if there are new facilities opening in your area.

Below is an outline of the top five capital investment warning signs and some of the items found within each category:

- Cosmetic Wear and Tear

- Public Spaces

- Floors/Carpeting

- Individual Living Units

- Counter Tops

- Lighting

- Electrical Fixtures

- Appliances

- Physical Plant Deterioration

- HVAC

- Elevators

- Commercial Kitchen

- Roof

- Exterior Elevations

- Functional Obsolescence

- Office Equipment

- Security System

- Video, Internet access

- Increased Operations Cost

- Optimize Energy Efficiency

- Repairs and Current Maintenance

- Deferred Maintenance

- Capital Improvements by Competitors

- Enhanced Public Spaces

- First Impression Improvements

- Exterior

- Interior

- Landscaping

- Front Entrance (Exterior)

- Building Elevations

- Window Treatments

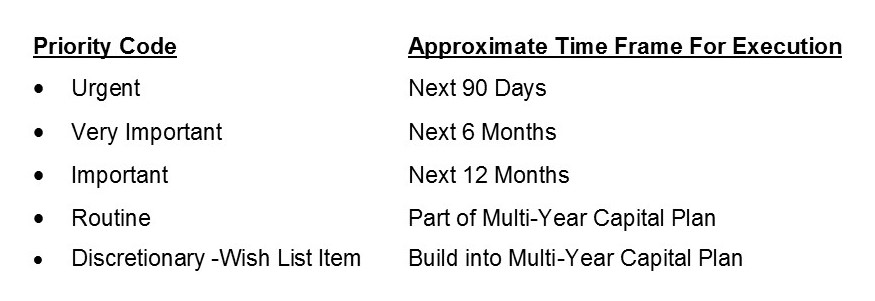

Obviously, this is not an exhaustive list. There are many other issues to potentially address. But this is a great place to start when evaluating where your community could use some attention. With each item you list, it needs to be accounted for in your capital budget plan. Assign it a priority code and then plug it into the Revolving 5-Year Capital Budgeting Plan as shown below.

Once you have identified your capital investment needs and assigned them a priority, you can determine dollar amounts needed to keep your community efficient and up-to-date with both existing competitors and new state of the art competitors that may be introduced into your market area.

SUMMARY OF A TYPICAL REVOLVING 5-YEAR CAPITAL BUDGETING PLAN

1Create similar spreadsheets of other priority categories summarized in our previous blog “Long Range Capital Investment Planning” dated January 4, 2018.

Staying on top of your current and future needs by proper planning will help keep you on top of prospective residents’ list of potential new homes.

The above was taken from Jim Moore’s book Independent Living and CCRCs; Survival, Success & Profitability Strategies for Not-for-Profit Sponsors and For-Profit Owner/Operators. Jim Moore is president of Moore Diversified Services, Inc., a national senior housing and healthcare consulting firm based in Fort Worth, TX that has been serving clients for 46 years. He has authored five books about senior living and healthcare including Assisted Living Strategies for Changing Markets and Independent Living and CCRCs. Jim Moore can be reached at (817) 731-4266 or jimmoore@m-d-s.com.