Creating an Orderly Seven-Step Plan Now Saves Money in the Future

Capital budgeting sounds complex and something only very large, sophisticated organizations can really implement. But, by executing some basic fundamentals, long-range capital budgeting for senior living can be one of your most important strategies for the future.

Up to 20 percent of older communities across the United States may no longer be able to effectively serve their future residents while being truly competitive in the marketplace. This is especially true in market areas that compete with newer, state‑of‑the‑art buildings. The term “older, functionally obsolete community” does not necessarily mean a facility that has been operating for 15 to 20 years. Some five‑year‑old communities have serious obsolescence and deferred maintenance problems.

How Did We Get There?

Faced with an aging physical plant, most operators can’t help but wonder, “How did we get in this position in the first place?” Part of the answer is related to the elusive concept of depreciation as a generally accepted accounting practice. Depreciation is a non‑cash (accrual) accounting expense. That means you don’t write someone a check for “depreciation” each month. Most buildings are depreciated annually over at least a 25- to 35-year period; using a conservative definition of the building’s useful life. If you are a for-profit, writing off depreciation allows you to save taxes and satisfy your CPA or auditor on paper, but the real issue is, “Are you actually investing any real cash in your aging community?”

The Unfunded Depreciation Trap and the Cap ‘X’ Solution

The problem with writing off depreciation is that you are not actually investing any real cash in your aging community. This “unfunded depreciation trap” is a recipe for trouble and it is creating major problems for many older senior living and health care communities.

Owner/operators and lenders are also using a capital budgeting concept called Cap ‘X’ (for “capital expenditure” or “reserve for replacement”). This is an imputed operations expense line item of approximately $250 to $350 per unit per year. For an older property with serious deferred maintenance, this assessment can be as high as $600 to $700 per unit per year. These funds are allocated, expensed, and reserved as real cash for future capital needs of a routine, generally predictable nature (wear and tear, cosmetic refurbishment, etc.). This allocation does not cover the more serious capital needs, such as roof repair or a major HVAC overhaul, etc.

Buyers and appraisers will also impute a Cap ‘X’ factor into your income statement that reduces their estimate of your community’s value. This can suddenly become troublesome for the owner/operator because Cap ‘X’ is an expense line item and every dollar is subject to the capitalization rate of approximately 7.0 to 7.5 percent (for independent living with some assisted living) in the 2017 time frame. As described above, Cap ‘X’ is a partial solution to the unfunded depreciation trap.

Most progressive new communities now deploy a Cap ‘X’ strategy along with a pragmatic, more extensive forward-looking annual capital investment plan.

The Capital Budgeting Process – A Seven Step Process

A relevant question to ask is, “Now that we recognize the problem, how do we properly plan for the future?” The answer is to deploy a pragmatic annual capital investment plan and strategy. A good technique is to combine your actual facility experience with available industry standards and guidelines. Here are seven key capital budgeting issues to address:

- What major points need to be considered when establishing a capital budgeting plan? Three important issues need to be addressed:

- Set capital budgeting priorities

- Determine payback or return on capital investment

- Evaluate your relative cost of ongoing ownership

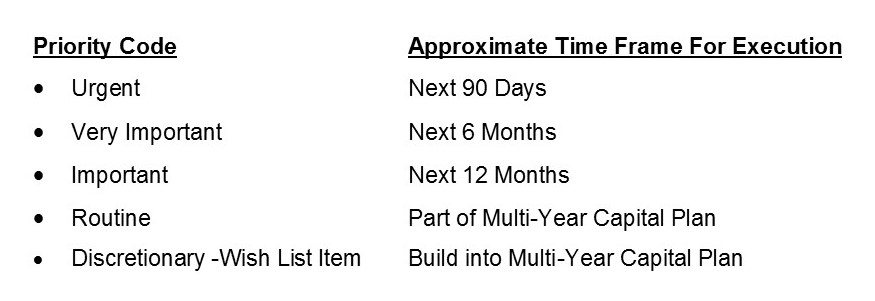

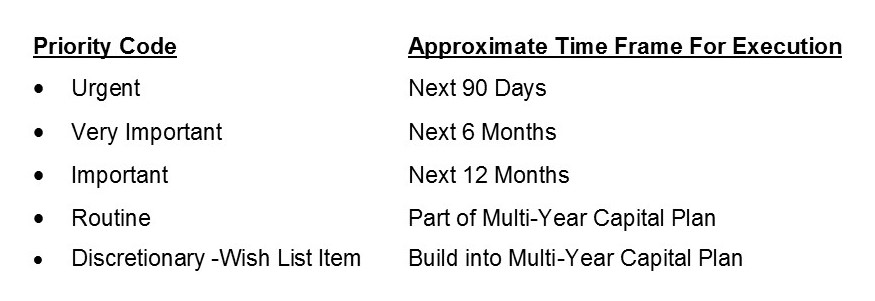

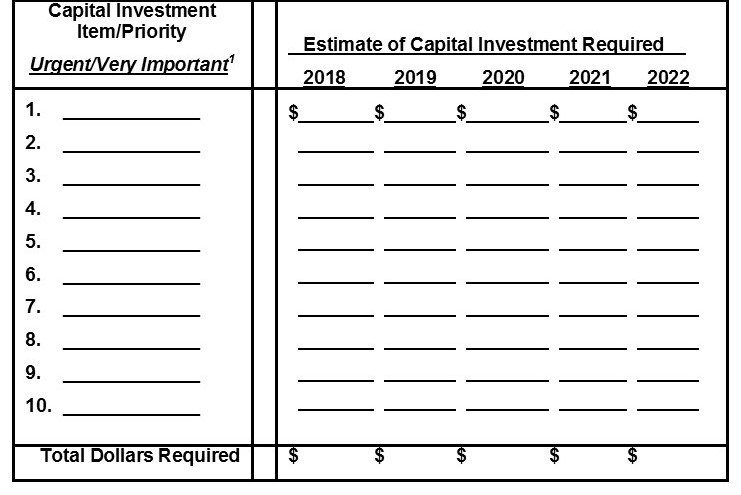

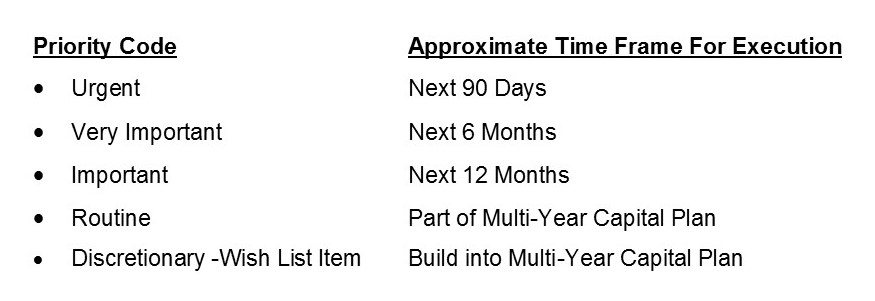

Prioritizing involves categorizing capital budget line items in a manner like those summarized below.

Wherever possible, you should target a minimum criterion of 6 to 8 percent cash return on your invested capital. Hopefully, every capital investment initiative will have a favorable return, either in the short-run or long-run. This is where the cost of ownership concept comes in. Estimate how a capital investment will affect your ongoing operations costs. For example, a $3,000 annual expense savings in an energy-efficient heating, ventilation, and air conditioning system may increase the value of your community by over $42,000 using a 7.0 percent valuation capitalization rate. The capitalization rate is the cash return (percentage) that reasonable buyers or investors would expect to realize on their cash investment. This would obviously be influenced by their perception of relative risk.

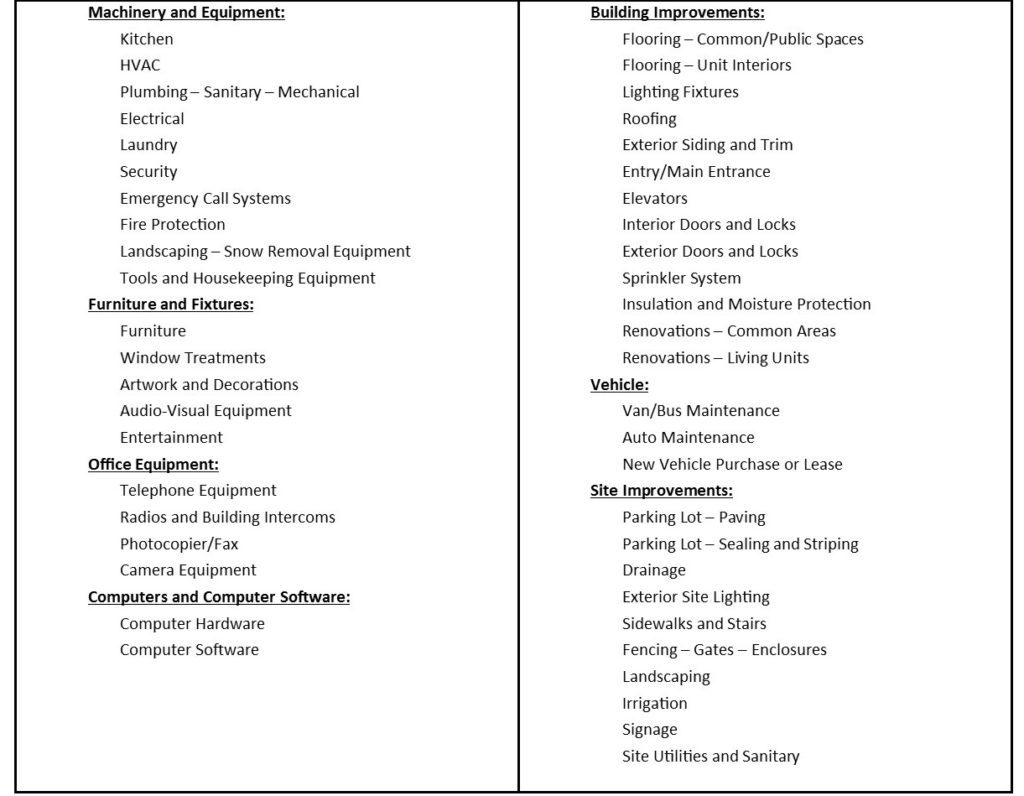

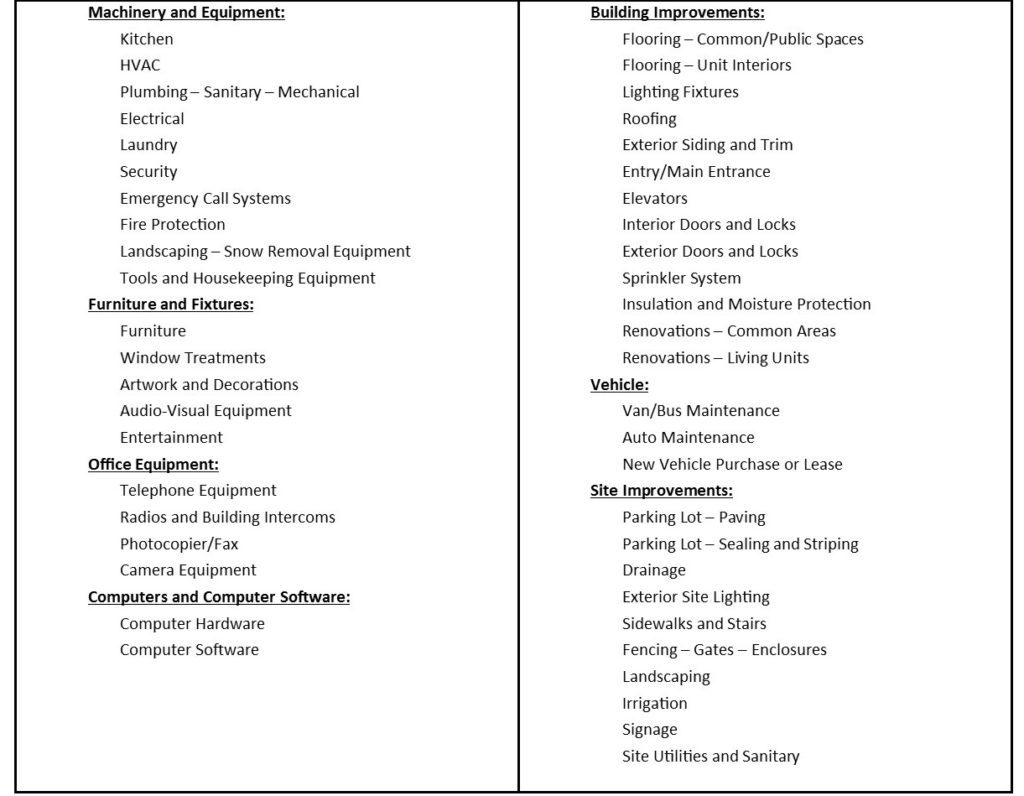

- Create a detailed punch list of possible capital investment items. Here is a suggested start of that punch list:

- Develop a pragmatic step‑by‑step capital budgeting process. Sound capital investment planning can be a five‑step process:

- List potential needs. Make a detailed list of potential capital investment needs ‑ all of the components, subsystems, and materials that make up your community. The list should be extensive, certainly including, but not limited to, those items listed above.

- Estimate each item’s life expectancy. Now, identify each item’s life expectancy and warranty expiration dates. Let’s take the roof, for example. First, determine its current age and then project the expected remaining life. When this is done to all the items on your list, you’re now in a position to estimate the likely need, cost, scope, and timing for future repairs and replacement costs at your community.

- Create a working spreadsheet. Insert all this information into a spreadsheet, listing potential repair and maintenance details vertically, with five‑year planning columns spread horizontally.

- Consider a revolving five-year plan. Create a revolving five‑year plan, updating your plan by adding an additional 12 months with every year that passes.

- Estimate costs. Insert budgetary cost estimates into the spreadsheet. You now have the basis for a simple, pragmatic and prioritized five‑year revolving capital investment program. There are also more comprehensive computer‑based software systems available to accomplish this task.

- How much time should you allocate for decision‑making, budgeting and actual execution? Whatever it takes. This effort will likely have a very high return on your time investment.

- What time of year should the process be initiated? The capital budgeting activity should be synchronized with your annual operations budgeting process. That’s because the annual financial budgeting process yields an estimate of next year’s cash flow. Revenues less expenses equals net operating income. Net operating income less debt service hopefully results in a positive cash flow. Your annual capital investment expenditures should typically come out of available cash flow proceeds generated in that year of operations.

- What other ways can I plan for future capital investment? Some organizations and lenders establish a previously discussed Cap ‘X’ concept. These funds are allocated, expensed, and reserved for future capital needs of a more routine, generally predictable nature (wear and tear, cosmetic refurbishment, etc.).

- Which administrative team members and department heads should be involved in the budgeting process? All of them. From an operations’ perspective, every major department (healthcare, dietary, housekeeping, plant maintenance, etc.) should be a stand‑alone cost and contribution to profit center. The capital budget plan should evolve from these same cost centers. Department heads should develop a reasonable rationale for each line requested. Management and administration (CEO, COO, CFO, etc.) should then negotiate and modify these budget numbers, resulting in a cohesive, achievable, value-engineered budget. This compels all the players to take ownership and implement the finalized capital budgeting plan.

Remember, capital investment is not just to spend money for obvious needs. It involves spending the right amount of money for the right items at the right time. This requires prudent capital investment planning that optimizes financial returns to the sponsor or owner/operator while delivering positive impressions and tangible benefits to current and future residents. Both of these lofty goals can be accomplished with the help of the basic capital investment principles described herein.

Call to Action

MDS has an extensive capital investment database that we use in comprehensive financial pro formas for our lenders, equity investors and not-for-profit and for profit senior living clients.

In an old TV commercial for the FRAM automobile oil filter, a cagey auto mechanic stood by a smoking engine and held up a filthy oil filter as he said, “You can pay me now, or you can pay me later.” Like skimping on an oil filter change, deferring needed repairs or replacements can be penny-wise and pound foolish for senior housing sponsors. “Later” can be synonymous with “very, very expensive.”

The above was taken from Jim Moore’s book Independent Living and CCRCs; Survival, Success & Profitability Strategies for Not-for-Profit Sponsors and For-Profit Owner/Operators. Jim Moore is president of Moore Diversified Services, Inc., a national senior housing and healthcare consulting firm based in Fort Worth, TX that has been serving clients for 46 years. He has authored five books about senior living and healthcare including Assisted Living Strategies for Changing Markets and Independent Living and CCRCs. Jim Moore can be reached at (817) 731-4266 or jimmoore@m-d-s.com.

THE OPTIMUM SENIOR LIVING EXPERIENCE

THE OPTIMUM SENIOR LIVING EXPERIENCE